Amortization of assets calculation

Subtracting the residual value -- zero -- from the 10000 recorded cost and then. This software is considered an intangible asset and must be amortized over its useful life.

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Easily Calculate Loans APRs and More.

. There is yet another method but it is not so common. After few years of using the asset if the company finds out that the intangible asset is. Useful Life of Intangibles 10 Years.

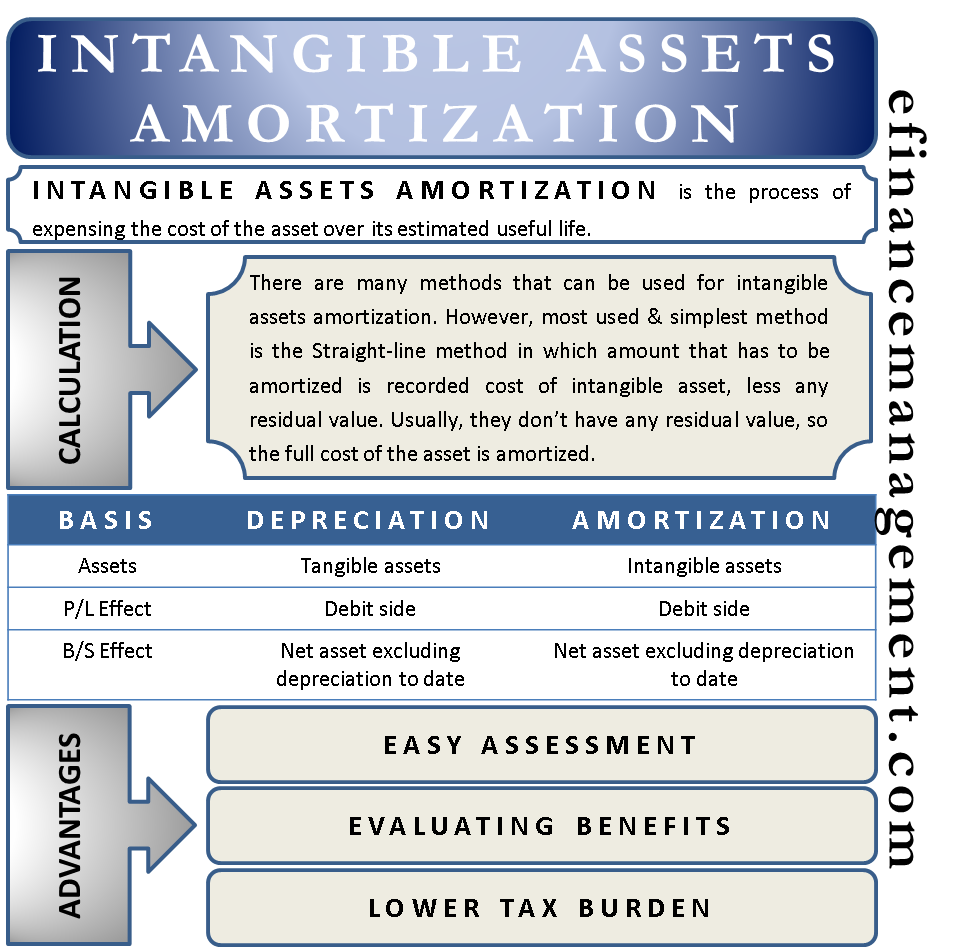

To calculate the value of assets we use two approaches- One is Depreciation and the other one is Amortization. Purchases of Intangibles 100k Per Year. First the company will record the cost of creating the software on its balance sheet.

It is also used to describe the repayment of a loan or finance agreement over a period of time. Ad Leading Software for Amortization. Intangible assets are non-physical assets.

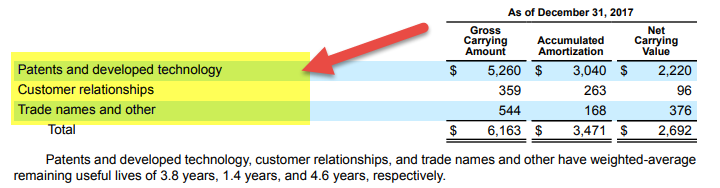

Part 122 - Glossary of Capital Assets Amortization Disposal Sale. In EBITDA Amortization refers to expensing intangible assets. Amortization is the accounting process used to spread the cost of intangible assets over the periods expected to benefit from their use.

Determining the Life of Intangible Assets. All capital assets wear out or decline in usefulness and value as they become. Beginning of Period Balance Year 1 800k.

The most capable and trusted financial calculation solution since 1984. It is more difficult to determine the useful life of an intangible asset than a tangible asset. After a few years of using the asset if the company finds out that the intangible asset is.

For intangible assets with an indefinite life that were acquired rather than created by your business the amortization period should be 15 years per the IRS. Amortization is an accounting term that describes the change in value of intangible assets or financial instruments over time. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. The customary method for. Loans for example will change in value depending on how.

The formula to calculate amortization is Cost of an asset Residual value Useful life of the asset. The company will use the straight-line method to report the amortization of the software. Amortisation refers to the routine decline in value of an intangible asset over time.

For intangible assets with an indefinite. In the subsequent step. The formula to calculate amortization is Cost of an asset Residual value Useful life of the asset.

Examples include goodwill copyrights patents trade names.

Amortization Of Intangible Assets Financiopedia

What Is Amortization Bdc Ca

Amortization Vs Depreciation Difference And Comparison Diffen

Amortization Of Intangible Assets Definition Examples

What Is Amortization Definition Formula Examples

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Of Intangible Assets Definition Examples

Intangible Assets Amortization All You Need To Know Efm

Amortization Options For Intangible Assets Valued Using The Income Approach Ds B

Amortization Of Intangible Assets Formula And Calculator

How To Amortize Assets 11 Steps With Pictures Wikihow

How To Amortize Assets 11 Steps With Pictures Wikihow

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Of Intangible Assets Formula And Calculator

Amortisation Double Entry Bookkeeping

Amortization Of Intangible Assets Formula And Calculator

Depreciation Of Fixed Assets Double Entry Bookkeeping