30+ Online payroll calculator 2021

Starting as Low as 6Month. Fast easy accurate payroll and tax so you save.

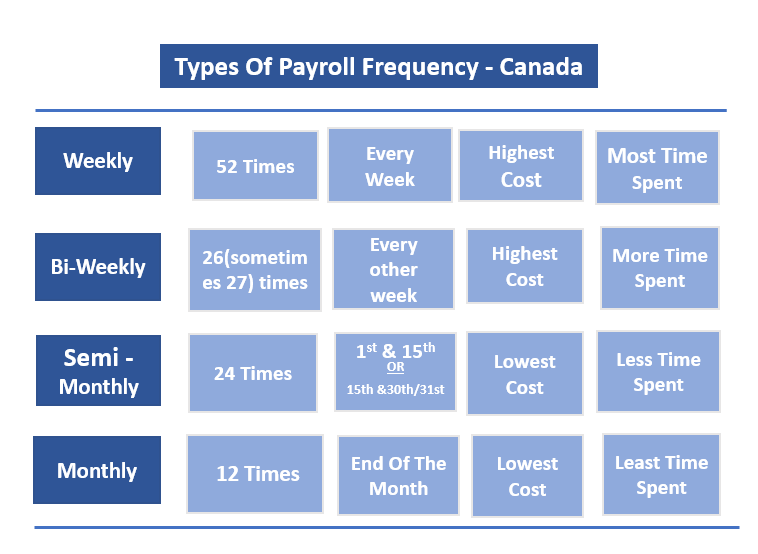

Everything You Need To Know About Running Payroll In Canada

How to calculate annual income.

. Free Unbiased Reviews Top Picks. Start Afresh in 2022. If you need a little extra help running payroll our calculators are here to help.

Taxes Paid Filed - 100 Guarantee. Heres a step-by-step guide to walk you through. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

How do I calculate hourly rate. 3 Months Free Trial. No Need to Transfer Your Old Payroll Data into the New Year.

We hope these calculators are useful to you. Use this calculator to help you determine the impact of changing your payroll deductions. More calculations more accuracy and a LOT less time.

The online payroll calculator that does more for less. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Ad Compare This Years Top 5 Free Payroll Software.

The state tax year is also 12 months but it differs from state to state. Free salary hourly and more paycheck calculators. No Need to Transfer Your Old Payroll Data into the New Year.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. When you choose SurePayroll to handle your small business payroll.

Updated September 30 2021. Next divide this number from the. Computes federal and state tax withholding for.

Find Easy-to-Use Online Payroll Companies Now. You can enter your current payroll information and. Try it free for 30 days with no contracts or commitments and.

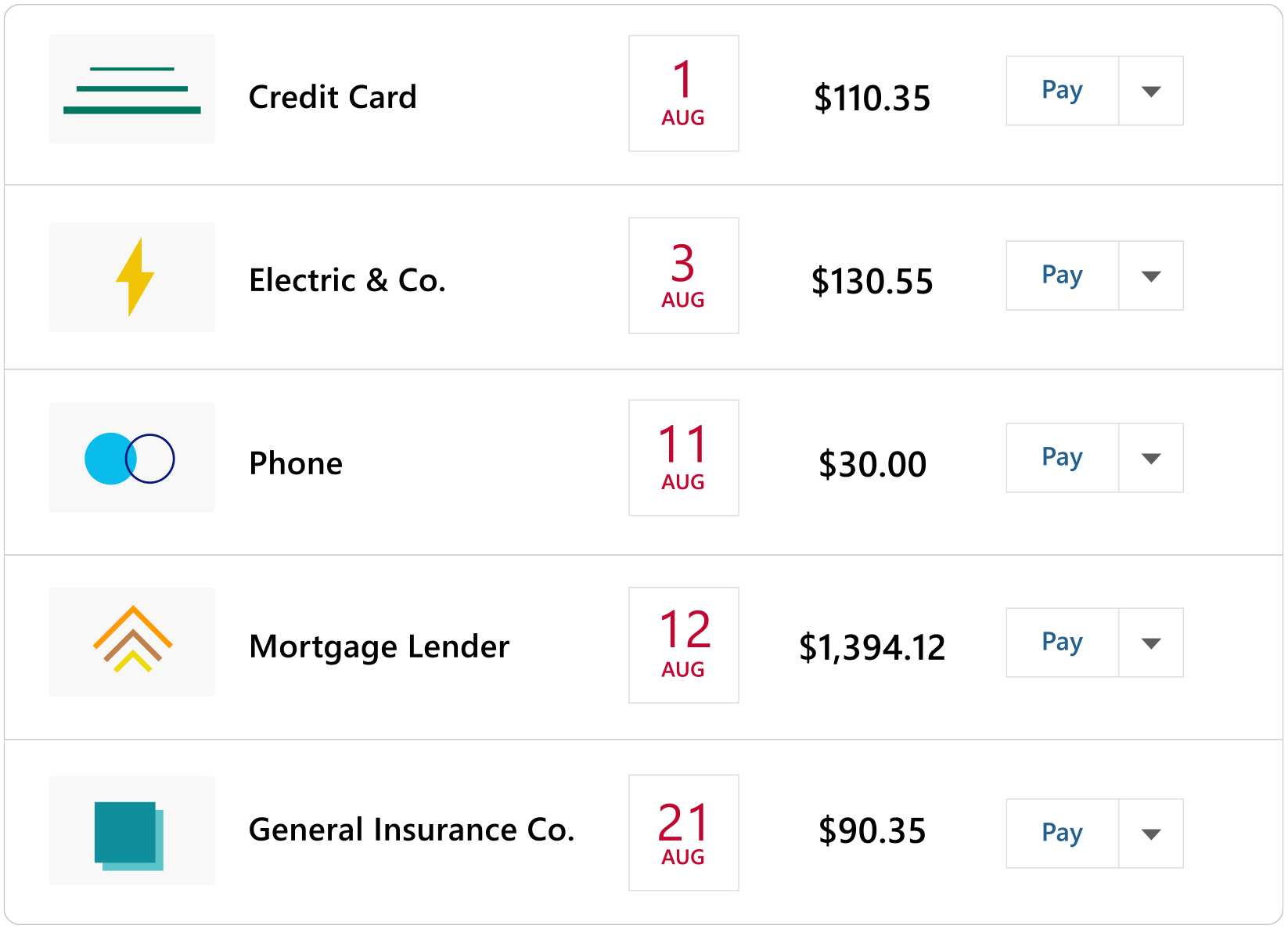

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Yearly Semi-annually Quarterly Monthly Bimonthly Biweekly Weekly Daily.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. If payroll is too time consuming for you to handle were here to help you out. Ad Compare This Years Top 5 Free Payroll Software.

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. Start Afresh in 2022. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

Ad Payroll Doesnt Have to Be a Hassle Anymore. It will confirm the deductions you include on your. Small Business Low-Priced Payroll Service.

Some states follow the federal tax. Free 2021 Payroll Deductions Calculator. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Heres a step-by-step guide to walk you through. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Taxes Paid Filed - 100 Guarantee.

Ad Payroll Doesnt Have to Be a Hassle Anymore. Rules for calculating payroll taxes. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

For example if an employee earns 1500. Free Unbiased Reviews Top Picks. Federal Salary Paycheck Calculator.

Enter your info to see your take home pay. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Double check your calculations for hourly employees or make sure your salaried. Find Easy-to-Use Online Payroll Companies Now.

Payroll Deductions Teaching Resources Teachers Pay Teachers

Quicken Home Business Quicken

How Do I Get Past This Error To Proceed Setting Up Qbo The Amounts Entered May Be Incorrect Ss Amp Medicare Taxes Fica Are Expected To Be Percentages

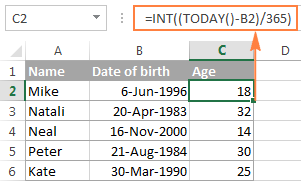

Excel Year Function Convert Date To Year Calculate Age From Date Of Birth

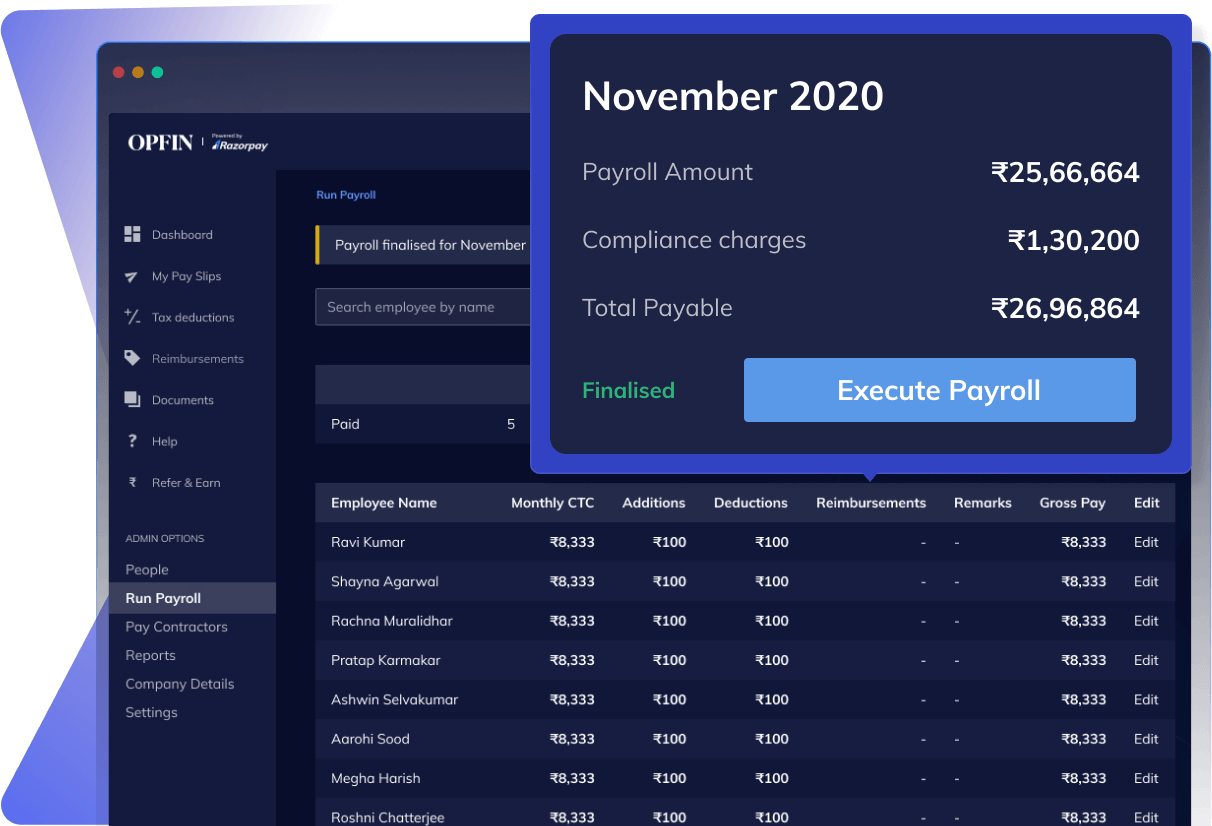

Online Payroll Processing Razorpayx Payroll

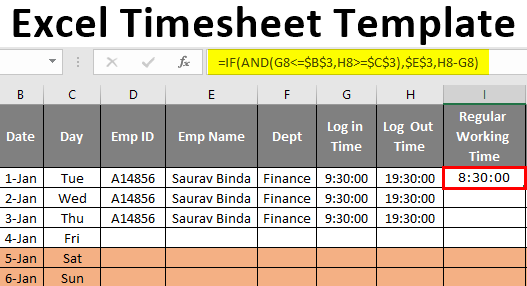

Free Timesheet Templates For 2021 Excel Word Pdf Running Remote

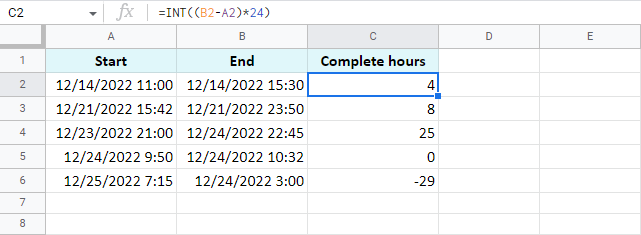

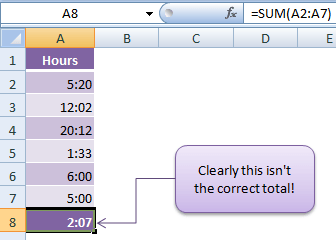

Calculate Time In Excel Time Difference Add Subtract And Sum Times

Quickbooks Desktop Pro Plus With Enhanced Payroll 2022 Accounting Software For Small Business 1 Year Subscription With Shortcut Guide Pc Download Everything Else Amazon Com

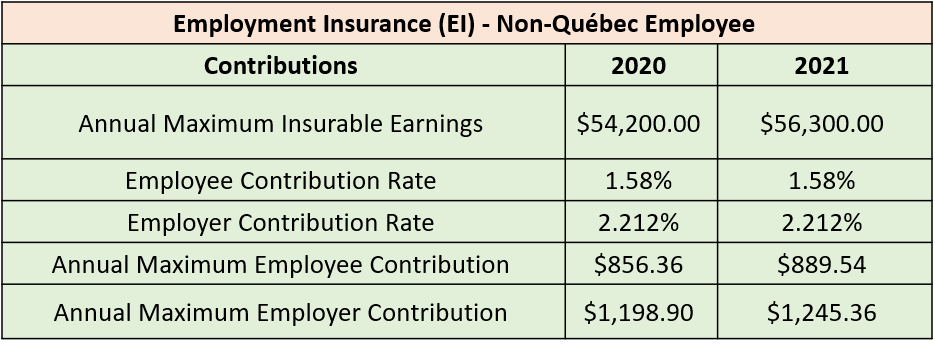

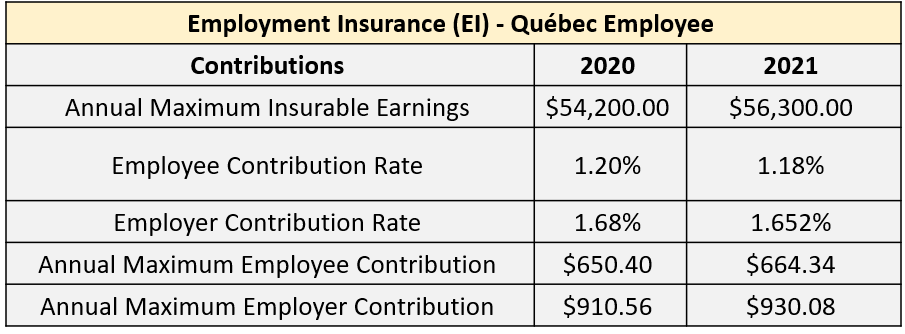

Everything You Need To Know About Running Payroll In Canada

Explore Our Example Of Payroll Schedule 2020 Template Payroll Calendar Payroll Calendar Template

Excel Timesheet Template Creating Employee Timesheet Template

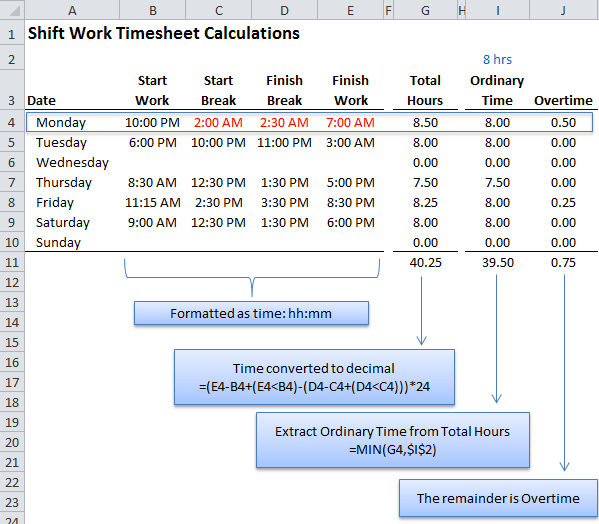

Calculating Time In Excel My Online Training Hub

Everything You Need To Know About Running Payroll In Canada

Calculating Time In Google Sheets

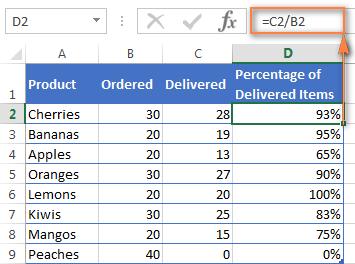

How To Calculate Percentage In Excel Percent Formula Examples

Calculating Time In Excel My Online Training Hub

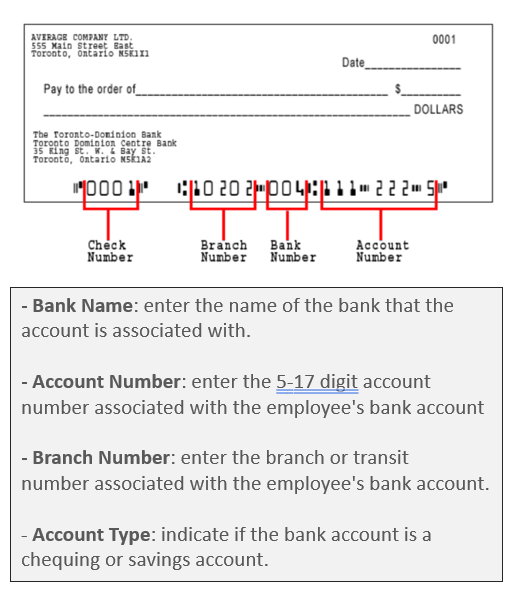

Everything You Need To Know About Running Payroll In Canada